What Everybody Ought To Know About How To Find Out Your Apr

Get up to 5 personalized loan quotes.

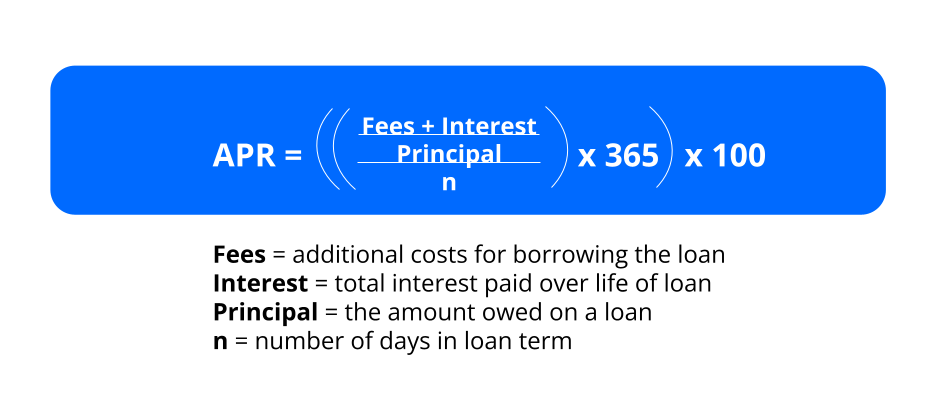

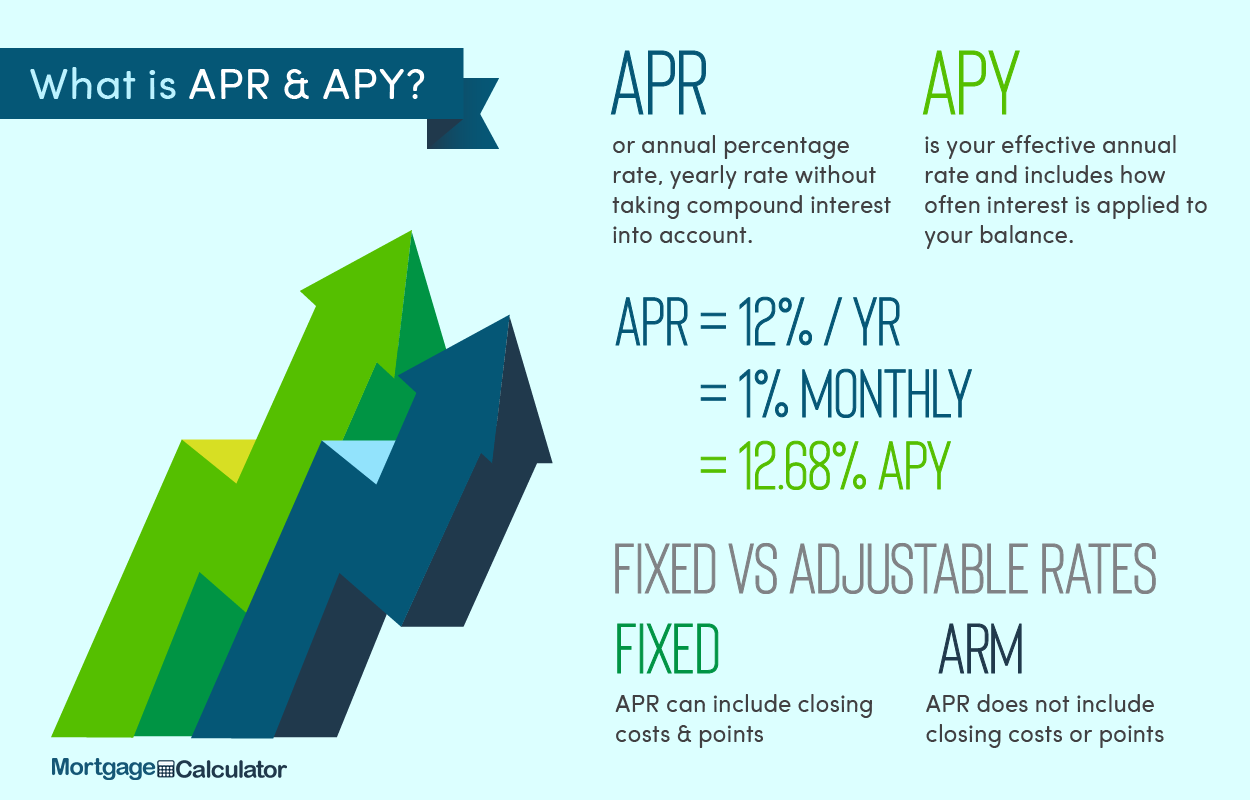

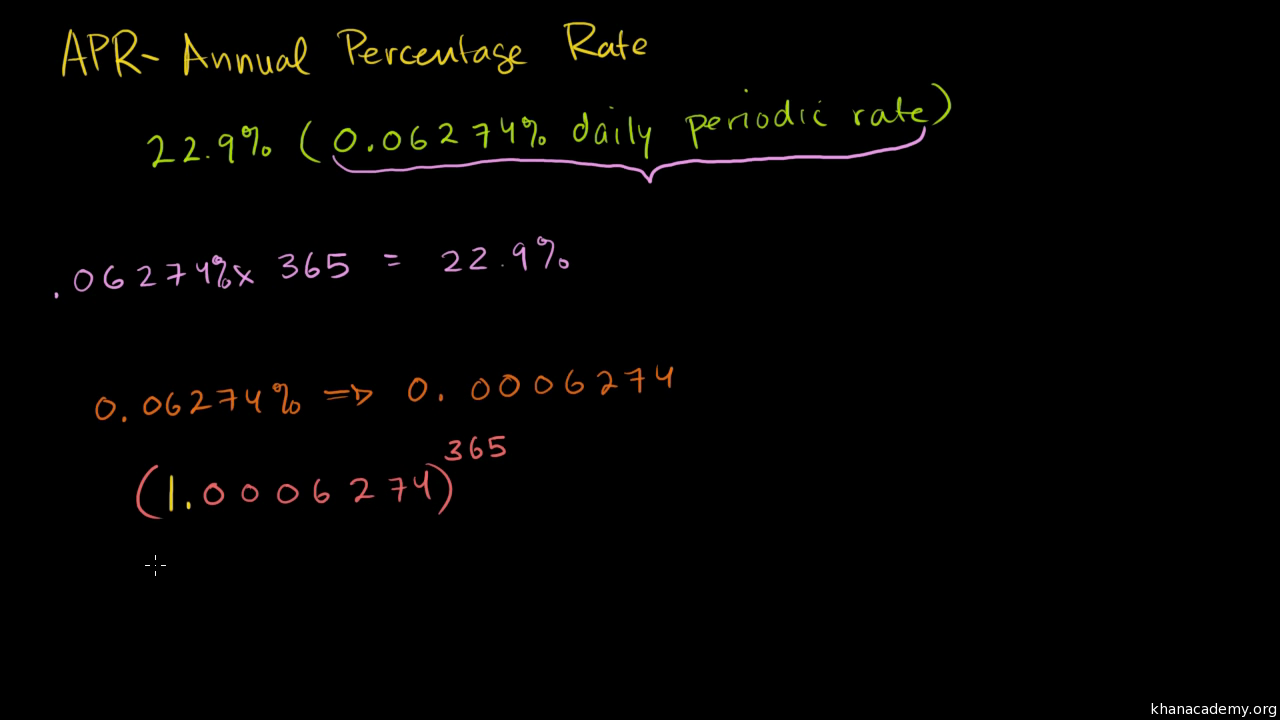

How to find out your apr. Calculate your daily apr in three easy steps: Prime rate is currently 5%. Calculate the interest rate add the administrative fees to the interest amount divide by loan amount (principal) divide by the.

If you didn’t compute your monthly income in step 1, or if you’re not sure if the monthly payment reflects expenses, keep in mind that this formula may not be the best way to calculate your. Divide the yearly interest amount by the total payments to calculate apr. Clearscore has also partnered with several credit providers to show your real apr before you apply.

Apr = [(0.2 / 730) x 365] x 100. Apr = [] x 100. You can view your annual percentage rate (apr) and interest charge calculation in your online account.

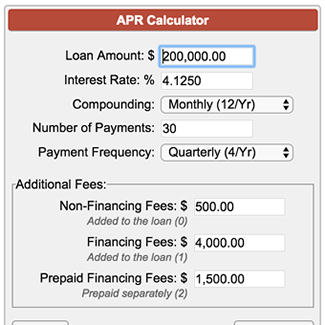

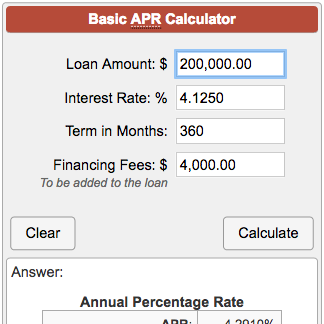

The bureau adds that sometimes issuers calculate the daily periodic rate by dividing by 360. Divide the total by the principal amount of the. To calculate apr on a $16,000 vehicle loan for five years (60 months) with a $400.

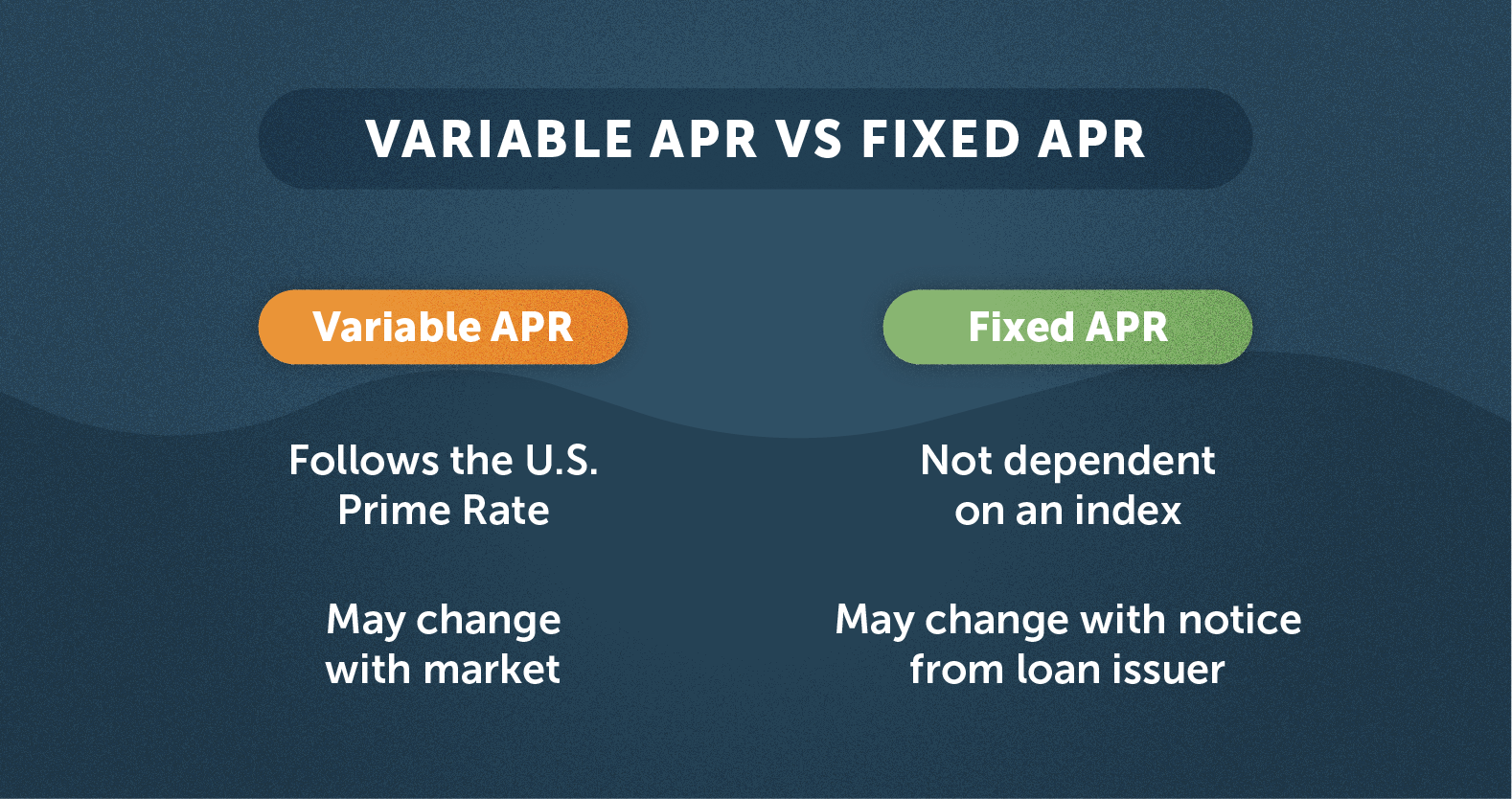

Adam then solves the equation using the order of operations to find the apr of the loan: Bank prime loan rate and the interest rate the credit card issuer charges. Find your current apr and current balance in your credit card statement.

Get a loan estimate from top lenders today! This appears next to products listed on the ‘offers' section of your clearscore. To find a credit cards apr, add the current u.s.

/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)